Improved task success rate

Improved task success rate

Improved task success rate

Improved task success rate

Improved customer satisfaction

Improved customer satisfaction

Improved customer satisfaction

Improved customer satisfaction

Increase in application completion

Increase in application completion

Increase in application completion

Increase in application completion

Client project

Figma, Miro, Illustrator, InDesign, Photoshop, Canva, pen & paper

Figma, Miro, Illustrator, InDesign, Photoshop, Canva, pen & paper

• Lead user interviews & research

• Competitor analysis

• Designed user journey

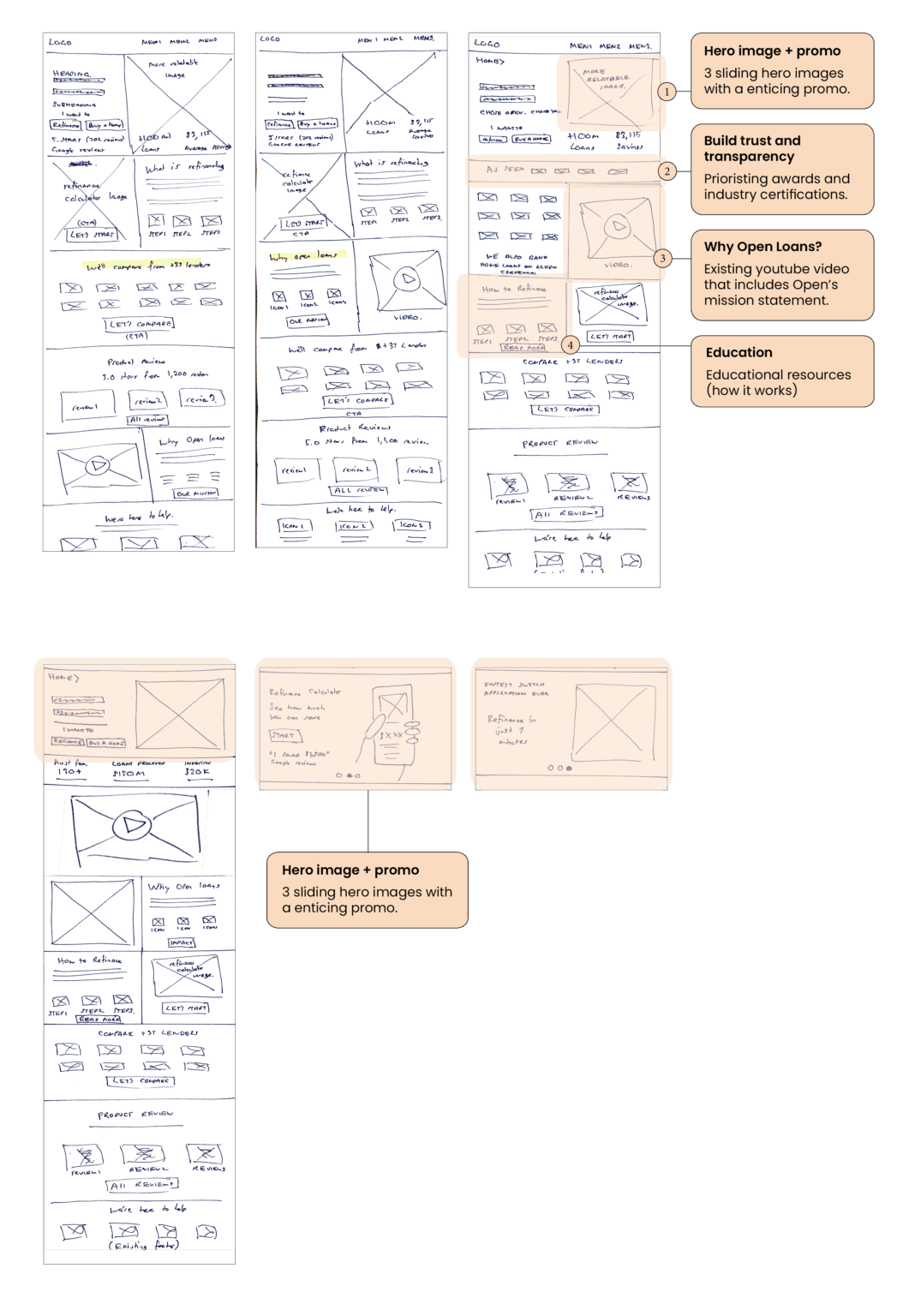

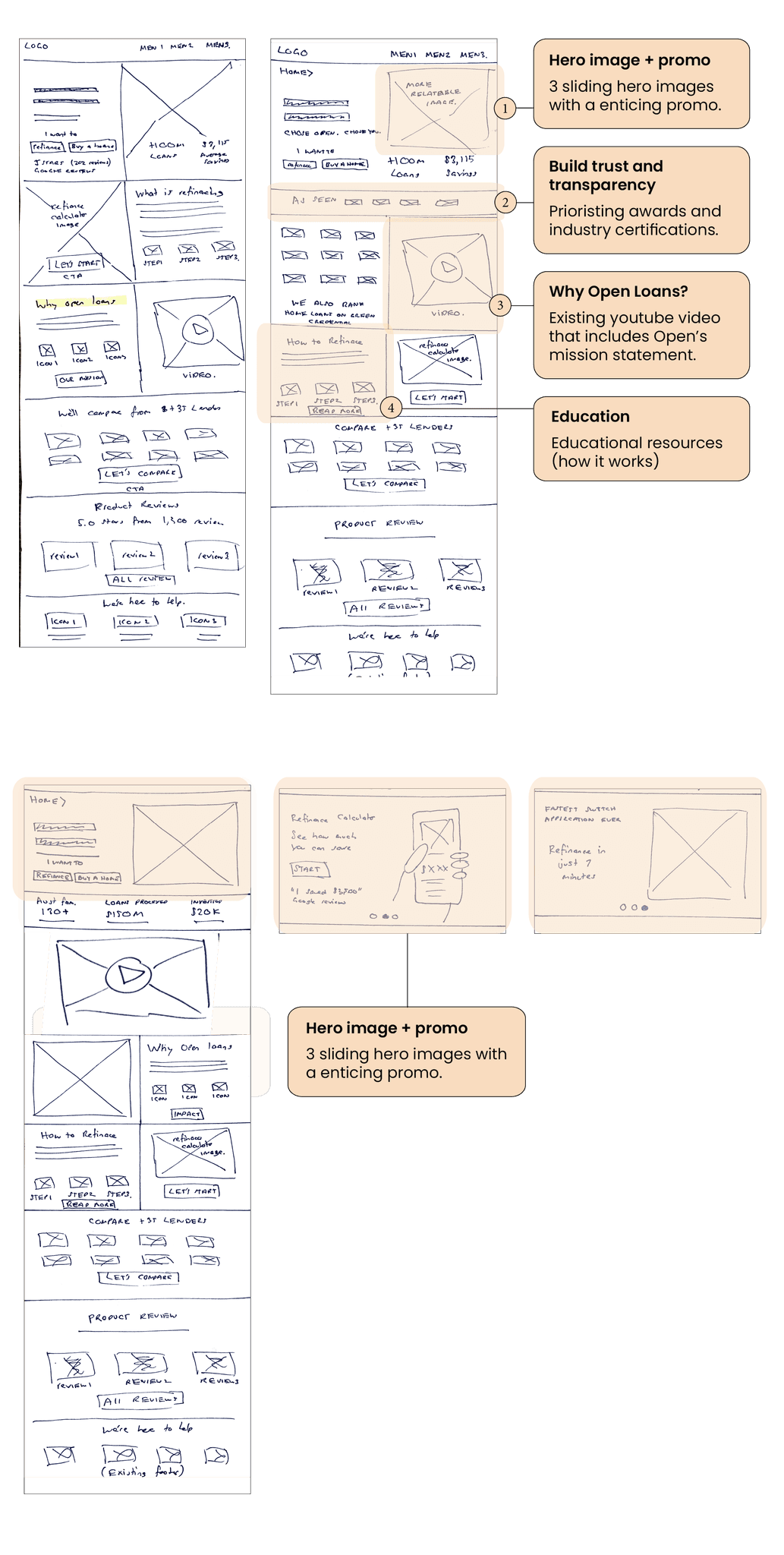

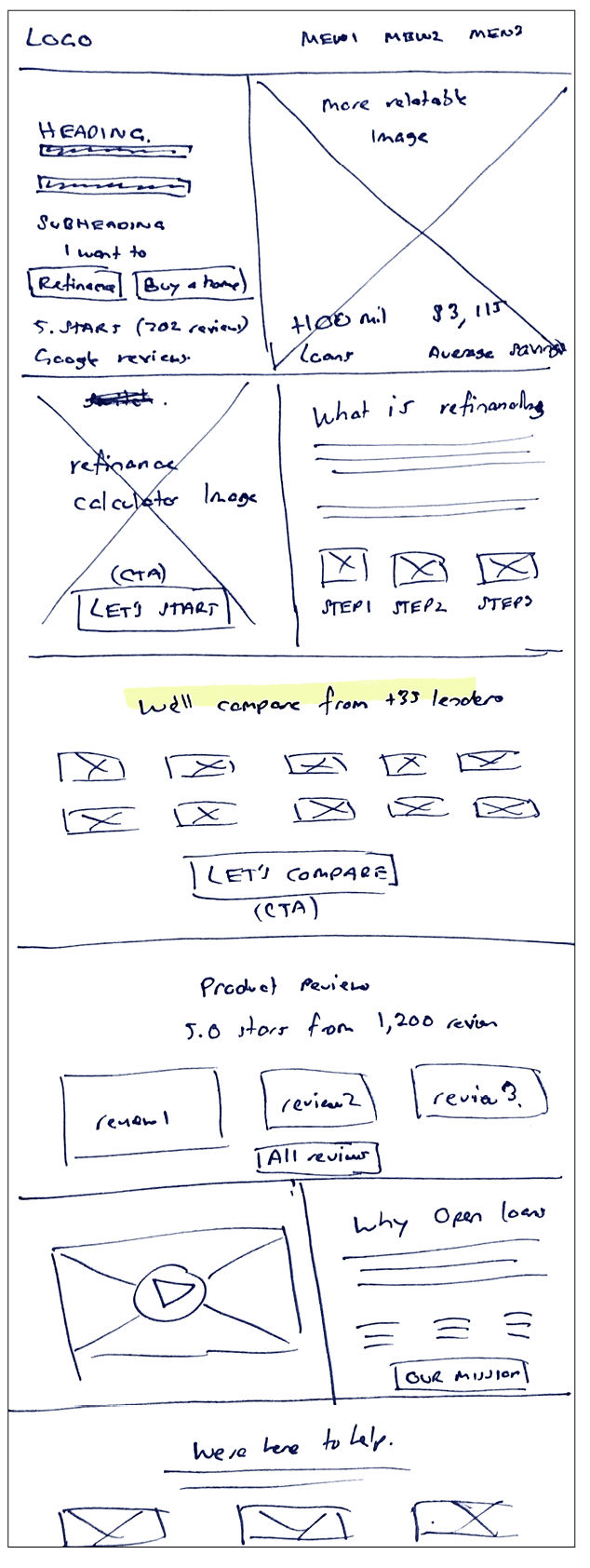

• Concept sketches

• Wireframe solutions

• Designed high fidelity

• Project management

I was a part of a cross-functional team that operated remotely and spanned across different

continents and time zones.

Project summary

Open Loans is Australia’s first digital broker, pioneering a new era for homeowners by leveraging digital brokering to negotiate the best mortgage rates from 35+ lenders. It has yet to conduct a comprehensive website review and associated applications.

The primary objective was to understand the pain points users experienced on the website and whilst using their 3 core applications:

Refinance application

Applying for a mortgage digitally.

Refinance

application

Applying for a mortgage digitally.

Refinance calculator

A comparison tool to assist users in their refinance decision-making.

Refinance

calculator

A comparison tool and calculator to assist users in their refinance decision-making.

Auto-negotiate feature

Notifies users when

to refinance (when it meets user requirements).

Auto-negotiate feature

Notifies users when

to refinance (when it meets user requirements).

The challenge

During our kick-off meeting, we explored Open’s objectives, project and the concerns employees had witnessed firsthand, along with insights captured from online data.

Through analytics and feedback, the results were:

Website

Despite strong traffic, conversion rates were low.

Website

Despite strong traffic, conversion rates were low.

Refinance application

Numerous individuals initiated the application process but did not finish.

Refinance application

Numerous individuals initiated the application process but did not finish.

Refinance calculator

Few users progressed from using the calculator to starting the application.

Refinance calculator

Few users progressed from using the calculator to starting the application.

Auto-negotiate feature

A significant number of users were unaware of this functionality.

Auto-negotiate feature

A significant number of users were unaware of this functionality.

Results

The client was happy with the final deliverables and has added this project to the pipeline. Due to a backlog of work, the client indicated that these updates will commence in Q1 2024.

Despite the absence of analytics on the proposed changes, the team are confident we’re headed on the right track. The team received positive feedback from usability testing which resulted in:

Improved task success rate

Improved task success rate

Improved task success rate

Improved customer satisfaction

Improved customer satisfaction

Improved customer satisfaction

Increase in application completion

Increase in application completion

Increase in application completion

Here’s the feedback I received from the client.

Figma, Miro, Illustrator,

InDesign, Photoshop, Canva, pen & paper

• Lead user interviews & research

• Competitor analysis

• Designed user journey

• Concept sketches

• Wireframe solutions

• Designed high fidelity

• Project management

I was a part of a cross-functional team that operated remotely and spanned across different continents and time zones.

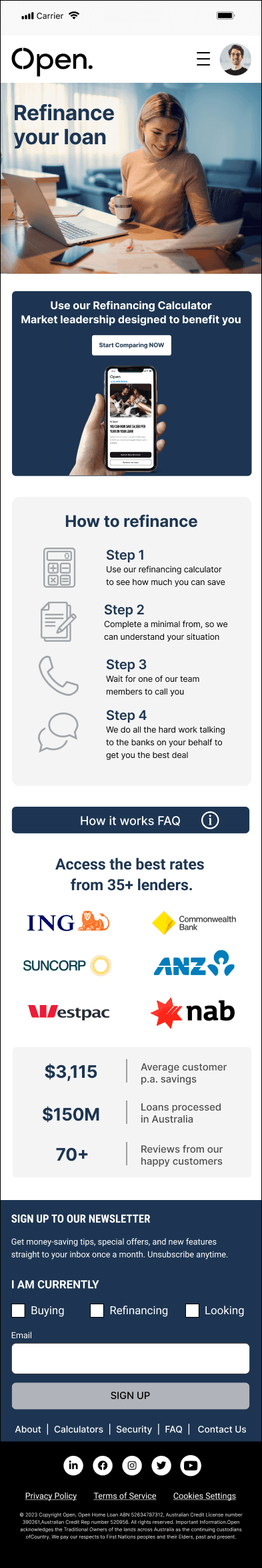

The solution: Streamlining the digital mortgage refinancing experience

I developed a strategic design package for the

Open Loans website and 3 x core applications.

Overall, the key actions we did:

Provided more clarity of what Open Loans is through promotional efforts

Delivered information that was relevant for uses

Highlighted interest rates and fee transparency

Supplied educational resources, including refinancing guidance, borrowing capacity calculations, and video content. This information contributes to fostering a sense of safety amongst users.

Homepage redesign with personalisation, brokerage

awards & “Why Open Loans?” video

The solution: Streamlining the digital mortgage refinancing experience

I developed a strategic design package for the Open Loans website and 3 x core applications.

Overall, the key actions we did:

Provided more clarity of what Open Loans is through promotional efforts

Delivered information that was relevant for uses

Highlighted interest rates and fee transparency

Supplied educational resources, including refinancing guidance, borrowing capacity calculations, and video content. This information contributes to fostering a sense of safety amongst users.

Refinance page revamp with personalisation,

building trust & education

Refinance page revamp with personalisation,

building trust & education

Research based approach to the Open Loans website redesign

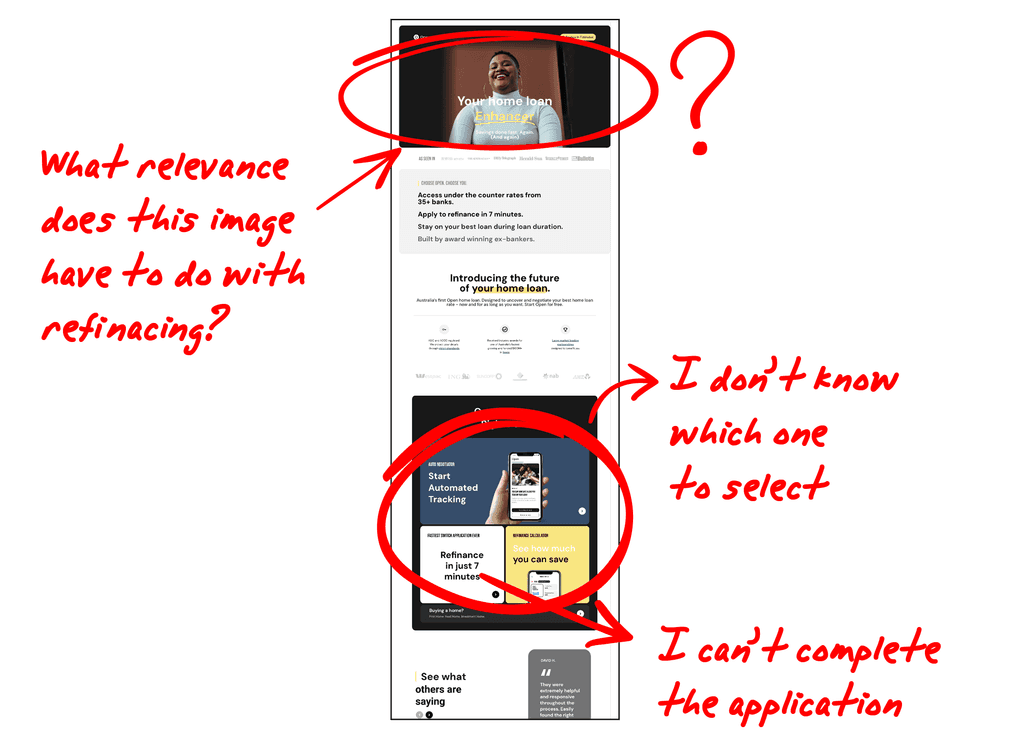

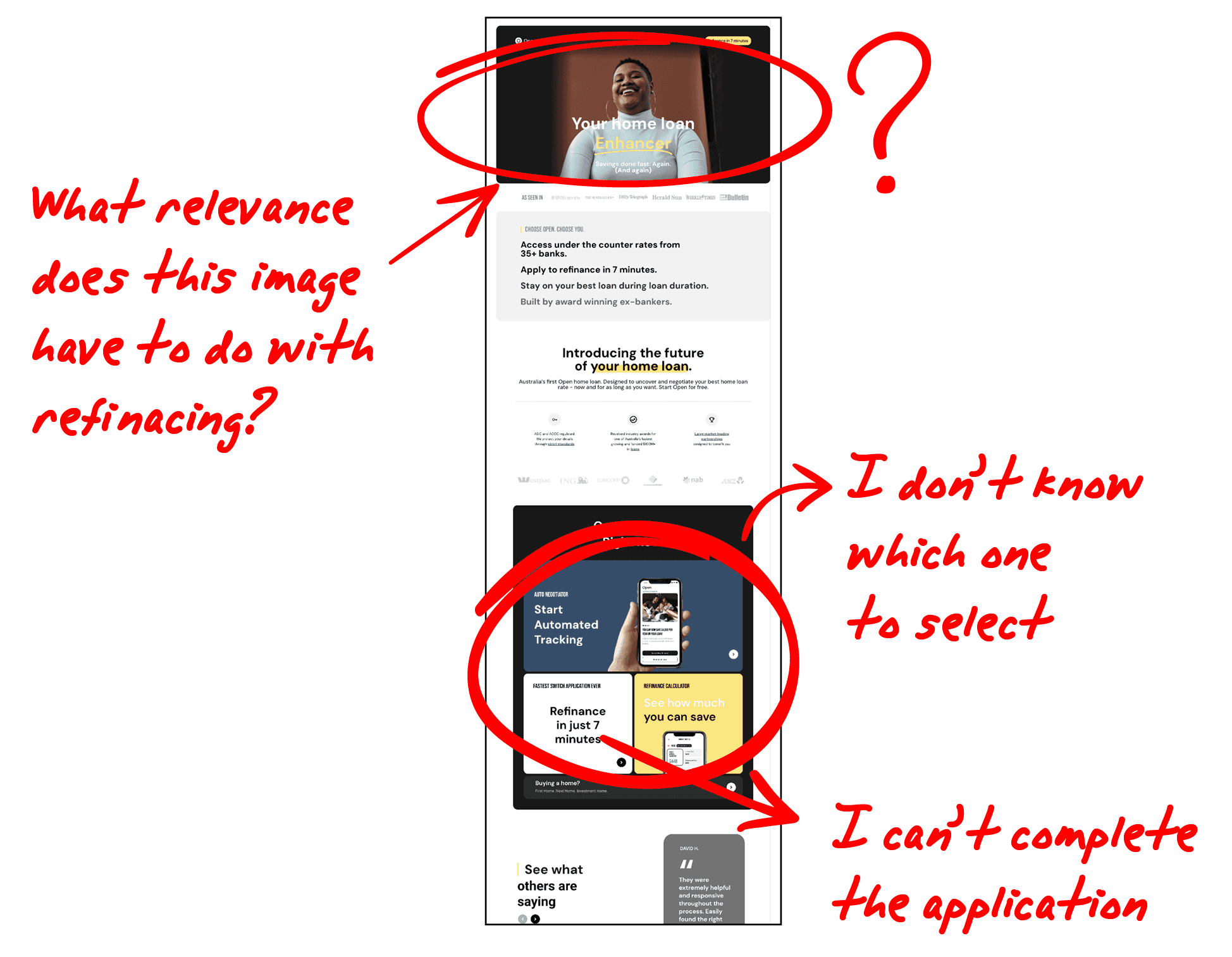

Heuristics evaluation: Uncovering unclear content, irrelevance & technical glitches.

The key issues were:

The home page left people unsure of what the site was about as it didn’t immediately communicate its content in a clear way.

Users felt some images were not relevant to home loans or finance.

Technical glitches during the application switch process hinder users from successfully completing their applications.

I planned 5 person interview to discover the frustration and confusion during the online refinancing process

I planned 5 person interview to discover the frustration and confusion during the online refinancing process

The key findings were:

Users were confused regarding the application’s process and there were no steps to guide them through

Participants found the functionality of widgets unclear

Some participants experienced sluggish performance on the website including application links not working

Users found the toolbar section lacking in visual appeal

The newsletter was not functional

I discovered users wanted clear information, expert guidance & streamlined refinancing

Needs / Likes

• Clear and concise information

• Simple application process

• Broker to remove any hassle

Pains / Dislikes

• Unclear industry jargon

• Buttons not functional

• No guidance on the refinancing process

To get a more in-depth understanding of the website’s functionality,

the team carried out a heuristic evaluation of the website.

To get a more in-depth understanding of the website’s functionality, the team carried out a heuristic evaluation of the website.

To get a more in-depth understanding of the website’s functionality, the team carried out a heuristic evaluation of the website.

The team then carried out a heuristic evaluation of the website to understand the current state of the website.

Heuristics evaluation: Uncovering unclear content, irrelevance & technical glitches.

The key issues were:

The home page left people unsure of what the site was about as it didn’t immediately communicate its content in a clear way.

Users felt some images were not relevant to home loans or finance.

Technical glitches during the application switch process hinder users from successfully completing their applications.

Heuristics evaluation: Uncovering unclear content, irrelevance

& technical glitches.

The key issues were:

The home page left people unsure of what the site was about as it didn’t immediately communicate its content in a clear way.

Users felt some images were not relevant to home loans or finance.

Technical glitches during the application switch process hinder users from successfully completing their applications.

Meet Jill: First time refinancer & needs guidance

Meet Jill: First time refinancer

& needs guidance

Meet Jill: First time refinancer & needs guidance

Background

Working professional

Homeowner of 7 years

Wants to reduce monthly expenses

Considering refinancing to save thousands

Frustrations

Information overload – Jill feels overwhelmed by too much refinancing information, making the process challenging for her to navigate.

First-time refinancer – As a first-time refinancer, Jill is navigating unfamiliar territory, and the lack of experience in the refinancing process contributes to her frustration.

Desire for clear guidance – Jill seeks clear and concise guidance during the refinancing process and is frustrated when faced with unclear or ambiguous information.

Information overload:

Jill feels overwhelmed by too much refinancing information, making the process challenging for her to navigate.

First-time refinancer:

As a first-time refinancer, Jill is navigating unfamiliar territory, and the lack of experience in the refinancing process contributes to her frustration.

Desire for clear guidance:

Jill seeks clear and concise guidance during the refinancing process and is frustrated when faced with unclear or ambiguous information.

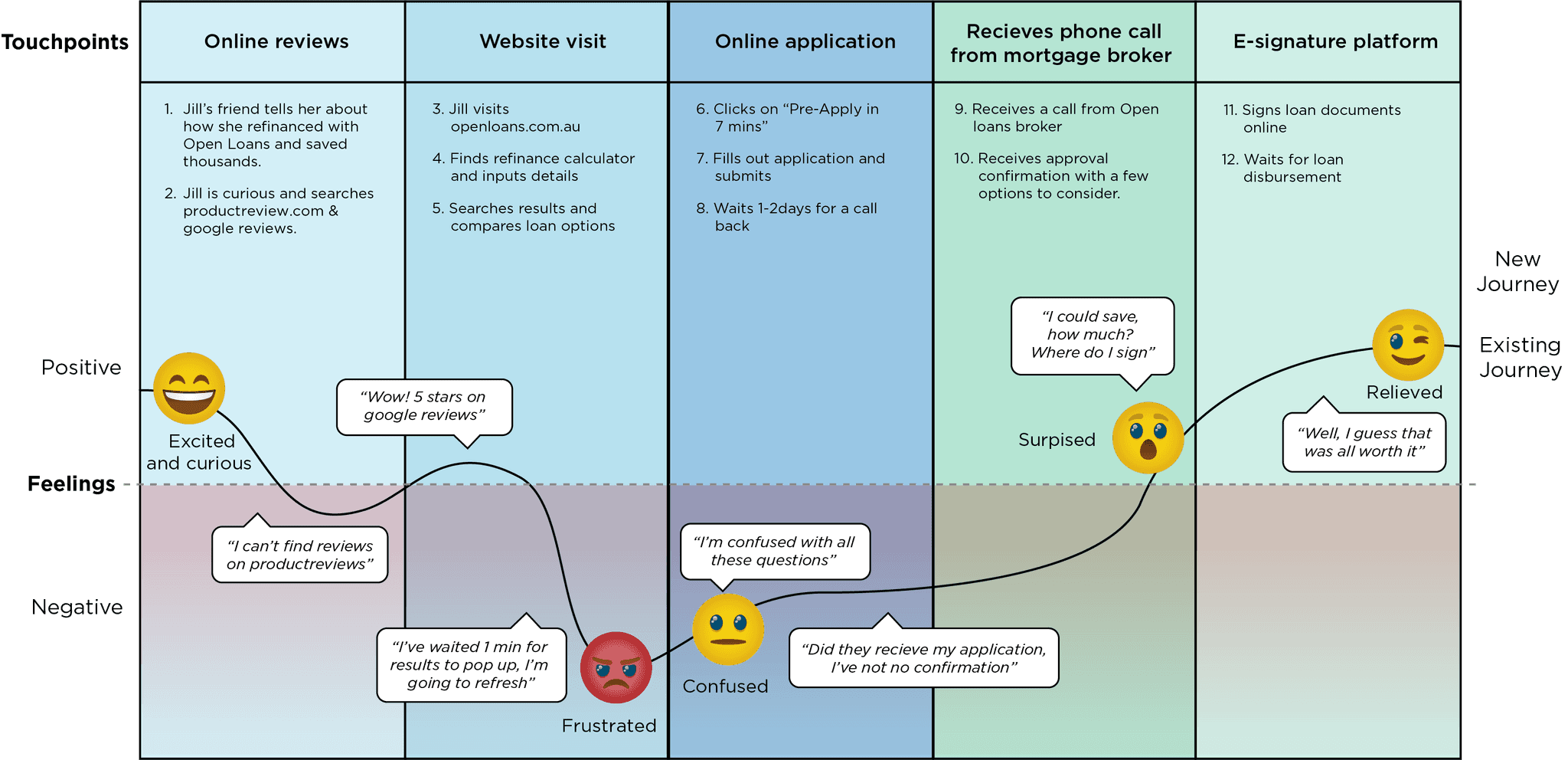

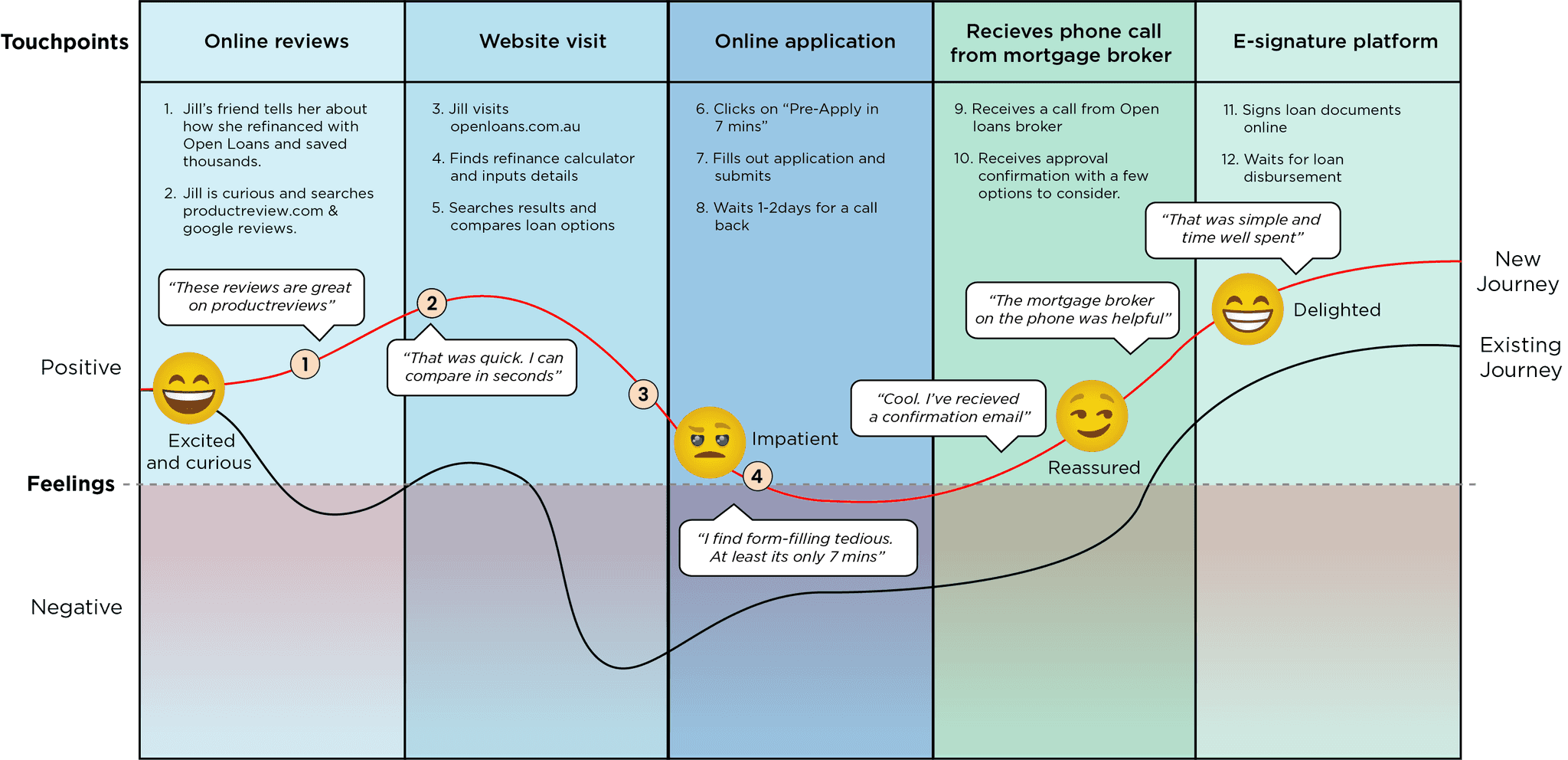

Jill, the financially savvy homeowner exploring refinancing options

I mapped out Jill’s current journey fraught

with frustration & confusion

I mapped out Jill’s current journey fraught

with frustration & confusion

Meet Jill: First time refinancer

& needs guidance

Scenario

Jill, is a homeowner who recently heard about Open Loans from a friend. Her friend mentioned how she saved over $2,000 per year.

She is eager to explore her options and save thousands like her friend. However, she is unsure of the process of refinancing.

Expectations

Clear, concise information

Ability to compare loans

Mortgage broker to take the hassle out

of refinancing

Problem

Despite consistently high website traffic, the conversion rates for users who proceed with mortgage refinancing are low.

Although users initiate the application process, analytics reveal a significant drop-off in completing the task.

Hypothesis

By optimising the user interface, simplifying navigation, and addressing identified pain points, I expect that users will find the Open Loans platform more user-friendly.

This, in turn, will lead to a decrease in bounce rates, an increase in completed transactions, and a higher overall user satisfaction score.

Key updates

The key findings were

Build ProductReview.com.au recommendations

Update website layout

Fix technical issues with the online

application form

Enhance the language in the online application to make it easily understandable for individuals who are new to the process of refinancing

Reflection: Prioritising further user testing for deeper insights and more refined solutions

This project has been a valuable journey, enhancing my understanding of user experience design while emphasising the importance of user-centric approaches.

Learning from the challenges and successes encountered during the Open Loans UX redesign, I gained insights into the iterative design process and the ongoing commitment needed to address evolving user needs.

If I had my time again, I would prioritise even more extensive user testing throughout the design process. While our initial testing was valuable, a more iterative approach, involving users at multiple stages, could have provided deeper insights and led to more refined solutions.

The team uncovered some crucial gaps in the experience through our research efforts.

Our research revealed functionality issues during the refinancing application process, significantly affecting bounce rates.

Through simplifying the website and offering additional guidance, users reported feeling more at ease and motivated to complete the refinancing application.

Fostering strong relationships across the company is essential for alignment in our product development goals.

Even the best service can falter if it doesn’t offer customers a smooth and hassle-free experience.

Website functionality is more important than aesthetics. Users are more likely to abandon the refinancing process if they encounter friction in their experience.

As I move forward, these lessons will undoubtedly shape my approach to future projects, emphasising empathy, clarity, and efficiency in designing solutions that connect with users.

Ready to create something outstanding?

Get in touch

© 2024. Designed by Gavin Prentice

Ready to create something outstanding?

Get in touch

© 2024. Designed by Gavin Prentice

Ready to create something outstanding?

Get in touch

© 2024. Designed by Gavin Prentice